A host of new tax credits are now available thanks to the American Recovery and Reinvestment Act (ARRA). The only drawback is that there are so many ways to reduce your tax bill by investing in energy efficiency and renewables, that it may be hard to keep track of them all.

While visiting Seaway Manufacturing Corporation in Erie, Pennsylvania today (they make energy efficient windows), Secretary of Energy Steven Chu reminded his audience that “Investing in energy efficiency is one of the quickest and most cost-effective ways reduce the energy bills in your home. We want to make sure that families that made those investments are taking advantage of the Recovery Act tax credits, which can put up to $1,500 into their pockets.”

Here are six tax credits that are often overlooked:

1.Residential Energy Property Credit (Section 1121)

The new law increases the energy tax credit for homeowners who make energy efficient improvements to their existing homes. The new law increases the credit rate to 30 percent of the cost of all qualifying improvements and raises the maximum credit limit to $1,500 for improvements placed in service in 2009 and 2010.

The credit applies to improvements such as adding insulation, energy efficient exterior windows and energy-efficient heating and air conditioning systems.

A similar credit was available for 2007, but was not available in 2008. Homeowners should be aware that the standards in the new law are higher than the standards for the credit that was available in 2007 for products that qualify as “energy efficient” for purposes of this tax credit.

2. Residential Energy Efficient Property Credit (Section 1122)

This nonrefundable energy tax credit will help individual taxpayers pay for qualified residential alternative energy equipment, such as solar hot water heaters, geothermal heat pumps and wind turbines. The new law removes some of the previously imposed maximum amounts and allows for a credit equal to 30 percent of the cost of qualified property.

3. Plug-in Electric Drive Vehicle Credit (Section 1141)

The new law modifies the credit for qualified plug-in electric drive vehicles purchased after Dec. 31, 2009. To qualify, vehicles must be newly purchased, have four or more wheels, have a gross vehicle weight rating of less than 14,000 pounds, and draw propulsion using a battery with at least four kilowatt hours that can be recharged from an external source of electricity. The minimum amount of the credit for qualified plug-in electric drive vehicles is $2,500 and the credit tops out at $7,500, depending on the battery capacity. The full amount of the credit will be reduced with respect to a manufacturer’s vehicles after the manufacturer has sold at least 200,000 vehicles.

4. Plug-In Electric Vehicle Credit (Section 1142)

The new law also creates a special tax credit for two types of plug-in vehicles — certain low-speed electric vehicles and two- or three-wheeled vehicles. The amount of the credit is 10 percent of the cost of the vehicle, up to a maximum credit of $2,500 for purchases made after Feb. 17, 2009, and before Jan. 1, 2012. To qualify, a vehicle must be either a low speed vehicle propelled by an electric motor that draws electricity from a battery with a capacity of 4 kilowatt hours or more or be a two- or three-wheeled vehicle propelled by an electric motor that draws electricity from a battery with the capacity of 2.5 kilowatt hours. A taxpayer may not claim this credit if the plug-in electric drive vehicle credit is allowable.

5. Conversion Kits (Section 1143)

The new law also provided a tax credit for plug-in electric drive conversion kits. The credit is equal to 10 percent of the cost of converting a vehicle to a qualified plug-in electric drive motor vehicle and placed in service after Feb. 17, 2009. The maximum amount of the credit is $4,000. The credit does not apply to conversions made after Dec. 31, 2011. A taxpayer may claim this credit even if the taxpayer claimed a hybrid vehicle credit for the same vehicle in an earlier year.

6. Treatment of Alternative Motor Vehicle Credit as a Personal Credit Allowed Against AMT (Section 1144)

Starting in 2009, the new law allows the Alternative Motor Vehicle Credit, including the tax credit for purchasing hybrid vehicles, to be applied against the Alternative Minimum Tax. Prior to the new law, the Alternative Motor Vehicle Credit could not be used to offset the AMT. This means the credit could not be taken if a taxpayer owed AMT or was reduced for some taxpayers who did not owe AMT.

For more information, see the IRS FAQ page, here.

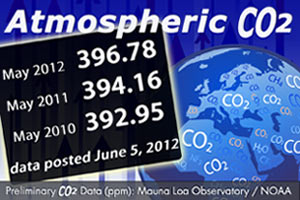

Filed under: All, CO2, Laws, Renewables, Solar, Wind

Trackback Uri